Gensol Engineering: Renewable Energy Ambition Crushed by Promoter Malpractices

The Roots of Gensol

Gensol Engineering, established in 2012 by brothers Anmol Singh Jaggi and Puneet Singh Jaggi in Ahmedabad, India, emerged as a solar engineering, procurement, and construction (EPC) firm. Riding India’s renewable energy wave, Gensol offered turnkey solar solutions, securing contracts with commercial and industrial clients. The company went public via an SME IPO in 2019, with promoters holding a 96% stake initially. Its early years focused on building a reputation as a reliable EPC player, laying the groundwork for diversification into emerging green technologies.

The Renewable Energy Boom

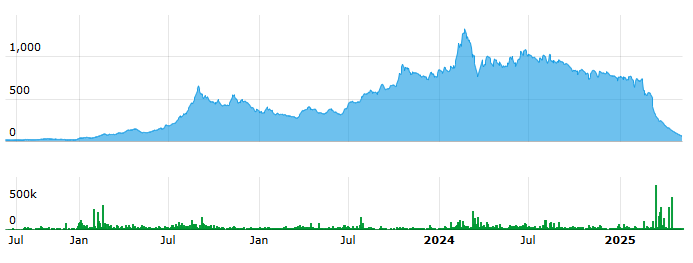

Gensol’s growth exploded between 2020 and 2024, propelled by its foray into electric vehicle (EV) leasing and battery energy storage systems. Standalone sales skyrocketed from ₹61 crore in FY17 to ₹1,297 crore in FY24, with net profits reaching ₹80 crore. The stock hit ₹1,331 in February 2024, reflecting a market capitalization of ₹4,131 crore. Gensol’s subsidiary, BluSmart Mobility, scaled EV leasing, while strategic MoUs, like one with Refex Green Mobility, bolstered its order book to ₹7,000 crore. The company announced pre-orders for 30,000 EVs by January 2025, cementing its image as a renewable energy innovator. Retail investors, holding 30.54% by December 2024, flocked to the stock, drawn by its green credentials and promoter optimism.

The Peak’s Fleeting Glory

Gensol’s high point spanned from late 2022 to early 2024, roughly 18 months. During this time, it ranked among India’s top 10 EPC players, with its Pune EV plant hailed as a milestone. The stock’s rally made it a retail favorite, but warning signs emerged: promoter share pledging reached 95.1%, and the debt-to-equity ratio climbed to 2x, signaling financial strain.

The Promoter-Driven Collapse

The unraveling began in March 2025 when CARE and ICRA downgraded Gensol’s debt to ‘D’ for loan defaults and falsified documents. On April 15, 2025, SEBI’s interim order exposed promoter malpractices, alleging Anmol and Puneet Jaggi diverted ₹207 crore of ₹978 crore in loans meant for EV procurement. Funds were routed through supplier Go-Auto to promoter-linked entities like Capbridge Ventures, used for luxury real estate, including a ₹50 crore apartment. SEBI barred the promoters from markets, halted a 1:10 stock split, and flagged risks to retail investors. The Enforcement Directorate raided Gensol’s offices, detaining Puneet Jaggi and freezing 500,000 shares for suspected money laundering. The stock plummeted 92% from its peak, hitting ₹86.50 by April 29, 2025, with market capitalization shrinking to ₹309.2 crore. X posts dubbed it the “#GensolScandal,” decrying promoter greed and governance failures.

| Red Flag | Description | Source in Public Disclosures |

|---|---|---|

| Promoter Share Pledging | 95.1% of promoter shares pledged, signaling financial distress. | Shareholding pattern in FY24 annual report. |

| Fund Diversion | ₹207 crore diverted to promoter-linked entities for real estate. | SEBI interim order, April 15, 2025. |

| Falsified Documents | Misrepresented loan documents to lenders for EV procurement. | CARE/ICRA downgrade reports, March 2025. |

| Governance Instability | Frequent CFO changes and independent director resignations. | BSE filings and annual reports. |

Investor Losses and Forensic Insights

Retail investors bore the brunt, with a ₹10,000 investment at the peak worth ₹650 by April 2025. The market cap loss of ₹3,821 crore obliterated shareholder wealth. Forensic analysis could have flagged red flags: excessive promoter pledging, non-binding MoUs inflating order books, and falsified lender documents. Frequent CFO turnovers, independent director resignations, and a social media blitz masking financial woes were additional signals. SEBI’s ongoing forensic audit aims to unravel related-party transactions and fund misuse.

Investor Tip: Detect Risks Early

Our SaaS platform empowers investors to spot governance lapses by analyzing promoter pledges, MoU credibility, and financial inconsistencies in public disclosures, preventing losses like those in Gensol’s collapse.

Conclusion

Gensol Engineering’s fall from a renewable energy star to a governance disaster exposes the risks of promoter-driven malpractices. Its ambitious growth hid weak controls, uncovered through forensic scrutiny of public filings. Investors, facing near-total losses, highlight the urgent need for tools to detect red flags in high-stake sectors.

Sources: India Today, SEBI, CNBC TV18, Moneycontrol