EKI Energy Services: A Carbon Credit Collapse Fueled by Governance Lapses

The Spark of EKI Energy

EKI Energy Services, founded in 2011 by Manish Dabkara in Indore, India, began as EnKing International, a climate change consultancy specializing in carbon credit advisory. Dabkara, an electrical engineer, identified a niche in helping businesses register and verify carbon offset projects. The company initially served small-scale clients in waste management and renewable energy, securing its first major government contract worth ₹1 crore in 2013. Operating in a nascent market, EKI built expertise in carbon credit auditing, laying the foundation for its later growth. Its early years were marked by steady but modest revenues, driven by consultancy fees in a low-awareness carbon market.

The Surge to Stardom

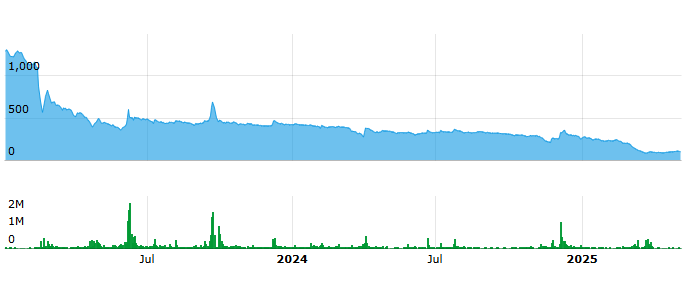

EKI’s trajectory changed dramatically after its April 2021 BSE SME listing at ₹35 per share (adjusted for bonuses). The global sustainability wave, amplified by COP26’s focus on carbon markets, propelled demand for carbon credits. EKI expanded into carbon trading, sustainability certifications, and green project development, positioning itself as a one-stop shop. By December 2021, its market capitalization soared to ₹4,124 crore, delivering 85x returns to IPO investors. The company claimed to supply 200 million carbon offsets, serving 3,500+ clients across 40+ countries. Its stock peaked at ₹3,149.98 in January 2022, fueled by high-profile MoUs, such as one with Shell, and aggressive management projections. EKI became a poster child for India’s green energy boom, attracting retail investors chasing multibagger returns.

The Peak’s Brief Reign

EKI’s zenith lasted from its 2021 listing to early 2022, approximately nine months. During this period, Q3 FY22 revenues hit ₹665 crore, with net profits surging. Management’s bold claims of dominating the global carbon market, coupled with frequent MoUs, kept investor sentiment buoyant. However, the stock’s meteoric rise raised eyebrows, as carbon credit markets are inherently volatile, and EKI’s revenue growth seemed unsustainable without transparent validation.

The Governance Unraveling

The collapse began in February 2023 when statutory auditor Walker Chandiok & Co. issued a qualified opinion, citing non-compliance with IndAS 115 revenue recognition standards. The auditor flagged potential overstatement of carbon credit revenues, questioning their realizability. This sparked a 51% stock price plunge in seven sessions, with shares dropping to a 52-week low of ₹568.80. Governance concerns escalated in August 2023 when EKI abruptly removed its auditor, citing “unreasonable fee hikes” and delays. Proxy advisory firm SES deemed the move unlawful without central government approval, highlighting promoter dominance (73.42% stake) in board decisions. X posts criticized EKI’s opaque MoUs and questionable deal structures, with some investors alleging inflated revenues from unverified carbon credits. By May 2025, the stock had lost 72% from its peak, trading at ₹877.75, with market capitalization under ₹1,200 crore.

| Red Flag | Description | Source in Public Disclosures |

|---|---|---|

| Inconsistent Revenue Recognition | Overstated carbon credit revenues due to non-compliance with IndAS 115. | Auditor’s qualified opinion in FY23 annual report. |

| Non-Binding MoUs | MoUs with Shell and others lacked binding financial commitments. | Company announcements and BSE filings. |

| Auditor Removal | Unlawful removal of Walker Chandiok & Co. without central government approval. | SES advisory report and BSE disclosure. |

| Promoter Dominance | 73.42% promoter stake influenced board decisions, limiting independence. | Shareholding pattern in annual reports. |

Investor Losses and Forensic Red Flags

Investors suffered massive losses, with a ₹10,000 investment at the peak reduced to ₹2,800 by mid-2023. The market cap erosion of over ₹2,900 crore devastated retail shareholders. Forensic analysis of public disclosures could have flagged multiple red flags: inconsistent revenue recognition (e.g., booking unverified carbon credits), non-binding MoUs lacking financial commitments, and auditor qualifications signaling financial opacity. The promoter-driven auditor removal and lack of independent board oversight were additional warning signs. EKI’s case underscores the need to scrutinize black-box accounting and management disclosures in high-growth sectors.

Investor Tip: Leverage Forensic Tools

To avoid such pitfalls, investors can use forensic analysis tools to dissect public disclosures. Our SaaS platform scans annual reports for revenue anomalies, auditor qualifications, and promoter-driven decisions, helping detect risks like those in EKI’s collapse early.

Conclusion

EKI Energy’s fall from a carbon credit leader to a governance cautionary tale highlights the dangers of unchecked growth narratives. Its rapid rise masked critical flaws in financial transparency and board independence, exposed through public disclosures. Investors, reeling from near-80% losses, emphasize the critical role of forensic analysis in safeguarding wealth in volatile markets.

Sources: Business Standard, CNBC TV18, Economic Times, SES Reports